TD Cash Credit Card

I recently picked up the TD Cash credit card during a recent apporama, one on my to do list for years. Indeed, the TD Cash is a solid, not-exactly-sexy product which I just hadn’t gotten around to pursuing. But I like complementing no-brainer cards from the major banks with more niche options. With this new card just showing up in my mailbox, I figured I’d share my experience so far with a bank and card less trafficked in our points and travel hobby.

TD Cash Credit Card Highlights

Welcome Offer

I applied for the publicly-available signup bonus which offers $150 for spending $1k in the first 90 days, plus 5% cash back on gas station purchases for six months (up to $6k spend). Offers can vary over time, but this has historically been the routine bonus, from what I can tell. TD also sends targeted snail mail offers here and there. My wife has been targeted for a $200 signup bonus with similar terms.

Digging Into Rewards

After setting up my online account and activating our new cards, I dug in more on the rewards side. To review, the TD Cash credit card offers a select group of categories from which cardholders can pick 3% and 2% cash back. These spend categories are:

- Dining

- Grocery Stores

- Gas Stations

- Travel

- Entertainment

While the first three categories are straightforward, let’s look at how TD defines travel and entertainment. Here’s what they say about travel:

The Travel rewards category may include merchants offering the purchase of airline tickets, hotel stays, car rental agencies, train tickets, bus lines, travel agencies, cruise lines along with parking and tolls.

And now, entertainment:

The Entertainment rewards category may include merchants with their primary business is for recreational and entertainment services including movie theaters, ticket agencies, amusement parks and tourist attractions.

While good to know, my 3% and 2% cash back decisions weighed more into the other categories – it was just a matter of selecting them. I’m describing that next.

Picking 3% and 2% Cash Back Categories

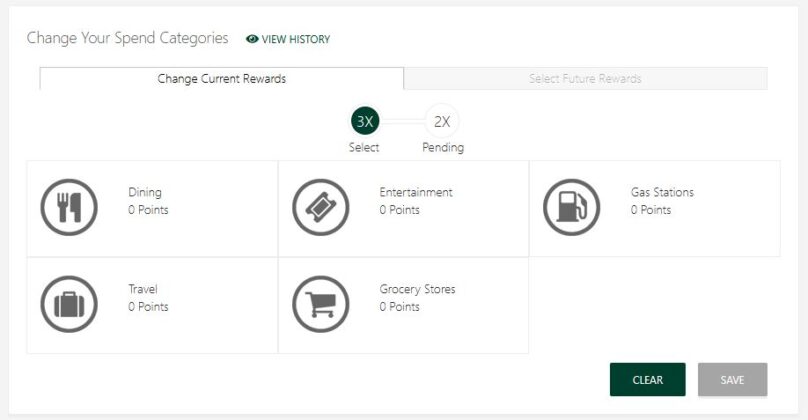

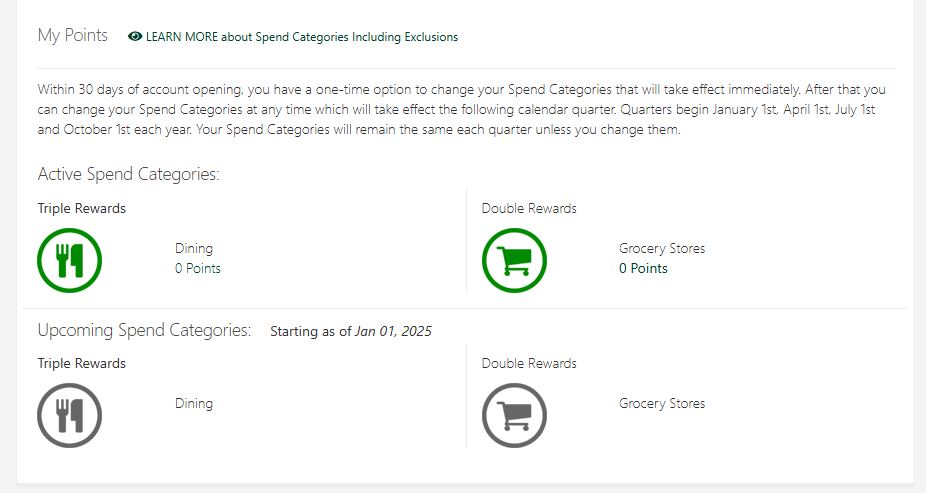

After logging in, selecting my TD Cash credit card account, clicking “Rewards” at the top right, then “Select Categories” at the top, I reviewed my initial rewards setup. The card defaults to Dining and Grocery Stores as the “Triple Rewards” and “Double Rewards” selections, respectively. Of course, these categories don’t optimally work for every cardholder. Fortunately, new cardholders can change these categories within 30 days of account opening. Cardholders can subsequently tweak their selections for future categories which take effect on the first day of the next quarter (see above).

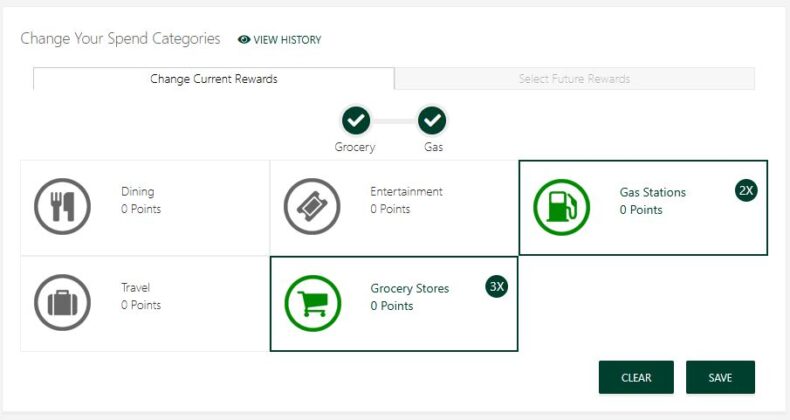

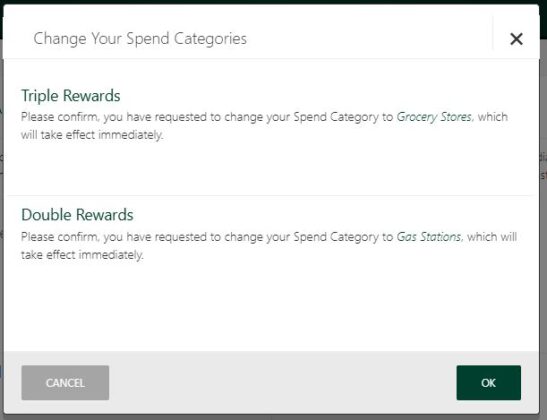

I decided to change my triple rewards category to grocery stores and double rewards category to gas stations. Doing so was simple enough, but I was required to pick both before saving. A cardholder must review and confirm their selections by clicking “OK” at the next prompt. The following screenshots summarize the process:

Changes were immediate and viewable at the top of the categories page, similar to the initial setup. I also had the option to select the next quarter’s categories but deferred that closer to next quarter. Things can change!

Woops, Maybe

I should admit I may have somewhat-bungled the 5% gas stations angle to the welcome offer. Only after picking my initial categories did I notice the fine print that the 5% gas station spend rewards comes in the form of an “additional 4%.” Given this, I probably should’ve assigned gas stations as my 3% category, not 2%. That may have meant 7% cash back on gas station spend up to $6k. Unfortunately, rewards from gas station purchases haven’t posted yet, so I can’t confirm at this point. For what it’s worth, here are TD’s terms related to the gas stations angle:

The Gas Station offer works by applying an additional 4% Cash Back for each $1 spent on eligible purchases spent at Gas Stations for the first 6 months from the account open date, or until you reach $6,000 in Gas Station purchases, whichever occurs first. At account opening, the Gas Station Spend Category will be assigned to the 1% Reward tier. Gas purchases made at superstores and warehouse clubs will only qualify for one (1) point, regardless of merchant category code (MCC).

Rewards Options

The TD Cash credit card offers multiple redemption options, but cash back is probably the wisest option for most. Cardholders have three selections for obtaining cash rewards: statement credit, direct deposit, and purchase redemption credit (think transaction eraser). For what it’s worth, I’m opting for direct deposit. That requires a minimum 2,500 points/$25 rewards balance (a statement credit has the same minimum threshold).

In my experience, points arrive a few days after transactions post and can be cashed out immediately, presuming a cardholder meets the minimum thresholds I described above. Similar to certain other banks, I enjoy that TD allows a cardholder to immediately cash out rather than waiting for a rewards deposit at statement cut.

Cardholders can also shop or book travel with their points, but I discourage these options. Third party gift cards are available at one cent per point, and the store also offers a bunch of random merchandise. A cardholder can book flights, hotels, and cars via the travel portal (also one cent per point). My advice is to ignore all this, cash out, and move on. You’re probably better off picking up any of this stuff at cheaper rates elsewhere while leveraging multiple discounts and points-earning opportunities.

I’m looking forward to more touchdowns with the TD Cash credit card.

I’m looking forward to more touchdowns with the TD Cash credit card.Conclusion

All of those rewards distractions (and maybe losing an extra $60 in rewards) aside, the TD Cash credit card offers a modest welcome offer and generous, customizable categories for earning 3% and 2% cash back. Rewards post in a timely manner, and cashing out is a low-maintenance process. I’m up for that most any day, even if it took me years to get around to this card. Casual rewards fans and more active hobbyists alike can find something to appreciate with the TD Cash. I happily signed up for this kind of boring, and maybe you should, too.

The post Easy Money – Getting Started with the TD Cash Credit Card appeared first on Miles to Memories.